Non Appointment of Company Secretary – NCLT fines Rs. 339,000 to the Company for inadvertent delay

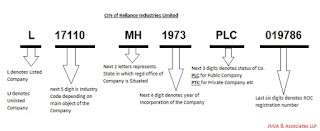

Atyati Technologies Private Limited (The Company) was incorporated under Companies Act, 1956 as a Private Limited Company with Registered Office in Bangalore. The Paid-up capital of the Company was Rs. 8.81 Crores. As per Rule 8A, it is mandatory for every company to appoint a Company Secretary in all the Companies having Paid up capital of Rs. 5 Crores or more. The Company filed a suo-motto filed a petition under Section 203 of the Companies Act, 2013 (The Act) read with Rule 8A of Companies (Appointment and Remuneration of Managerial Personnel) Rules, 2014 with a prayer for compounding violation committed under Section 441 of the Act. The Company pleaded that though since the commencement of new Companies Act, 2013, i.e. April 01, 2014 the Company could not appoint any Professional as a CS as no CS was willing to work with the Company as Company being a Private Limited Company there was very limited scope of work. As per Section 203 (5), if a company contravenes the provision